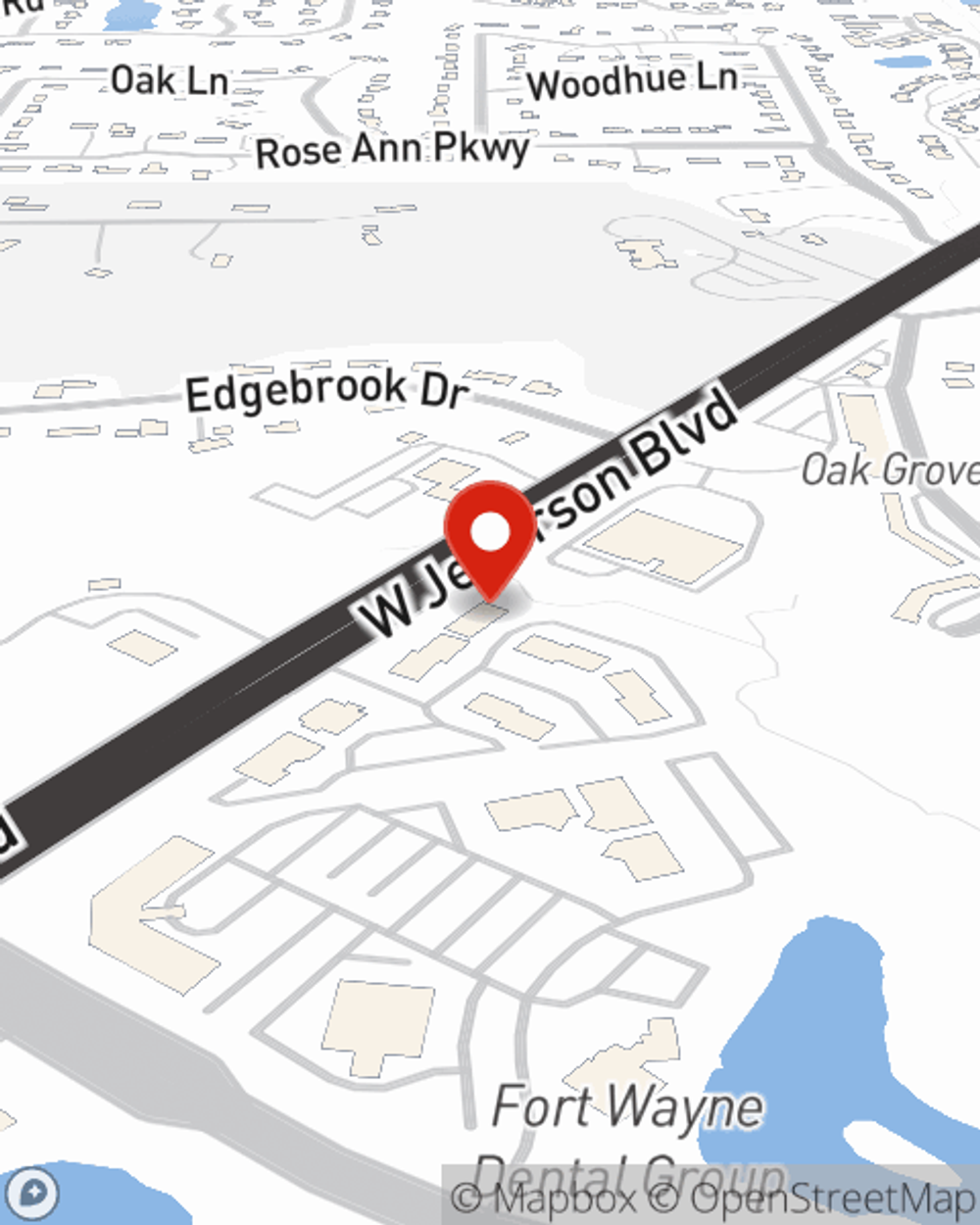

Business Insurance in and around Fort Wayne

Fort Wayne! Look no further for small business insurance.

Helping insure small businesses since 1935

- Fort Wayne

- Allen County

- Roanoke

- Decatur

- New Haven

- Columbia City

- Huntington

- Edgerton

- Hicksville

- Antwerp

- Paulding

- Van Wert

Insure The Business You've Built.

Preparation is key for when the unexpected happens on your business's property like an employee getting injured.

Fort Wayne! Look no further for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

With options like a surety or fidelity bond, errors and omissions liability, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent LaTasha Johnson is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent LaTasha Johnson today to explore your business insurance options!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

LaTasha Johnson

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.